Wednesday, December 23, 2009

Transparent Automated Trading Strategies

CLEARBOXTM http://www.jsservices.com/Clearbox/ClearboxIntro.wmv

CLEARBOXTM Trading Systems are transparent automated trading strategies. They are automated strategies in which you understands the developer’s criteria and can run strategies that best fit your trading plan.

A portfolio of unique transparent buy and sell strategy templates are made available that look to capture opportunity in specific market conditions and context. The CLEARBOXTM approach is a directed trade assist tool that provides hard entry and exit criteria with user's discretionary position and risk management.

The CLEARBOXTM Trading Systems are designed to provide an actionable knowledge based solution for both the professional and self-directed traders. The systems are completely automated but are meant to be used as a trading tool and to be piloted by a trader, not run as a “Blackbox”. Traders are advised to take either a Basic Money Management or Advanced Position Management approach when running the strategies. The strategies can be optimized using JS Services Price Map chart overlay to enhance position and risk management of the systems.

Markets currently available are SP500, EuroStoxx, BUND, 30YR T-Bond, GOLD, EuroFX.Coming soon: 10YR T-Note, DAX, ND100, EURUSD, GBPUSD, USDJPY

For more information please contact info@clearboxtrading.com

JS

Monday, December 21, 2009

USDJPY - PRESSING THE POSITIVE TURNING POINT

The MKT is pressing the upper edge of its neutral digestion at the 9164 resistance pivot and will need to generate a positive push today if it is to avoid falling back into a corrective trade.

On the Sell side REVERSAL strategies off the 9164 and 9241 levels will work best as any false positive signal is expected to provide a sharp negative reaction. FADE strategies off the 9164 level are valid but will work better after the 2nd or 3rd press into an area. BREAKOUT below the 9010 support Inflection Pivot are a lower probability and should be used as a signal for a FADE strategy against the 9087 Directional resistance.

On the Buy side FADE and REVERSAL strategies are recommended off the 9087 and 9010 pivotal levels, especially if the previous session low point remains intact. BREAKOUT strategies above 9164 should hold structure after a resistance breach if they are going to follow through targeting 9318 and 9434. Any break in momentum and the market will be vulnerable to drop back into a digestive trade.

Note: The MKT may need a session or two to catch its breath. Keep an open mind and let the MKT tell you was is.

JS

This post supports the Strategy Based Trading, which is a methodology that focuses on the applied strategy verses a specific market. The approach looks to align strategies with markets whose current technical behavior matches the strategies criteria. Please review the following CME sponsored tutorial for a complete overview of this approach.

STRATEGY BASED TRADING Reviewhttp://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Thursday, December 17, 2009

CORN H'10 - NEUTRAL NEGATIVE EXTREME

Technically the MAR'10 CORN market is at an extreme and is ready to either pop back into a firm neutral posture or break into a new down trend. Key off the 397-6 Inflection Pivot for an indication of the session tone.

On the SELL side BREAKOUT strategies below 391-2 should be worked as repeated tests of support are expected to give way to negative follow through. This strategy is vulnerable to the market, expanding its lower support band in a series of starts and stops. FADE strategies against 397-6 and 404-2 should expect an immediate reaction as any held trade or violation of major resistance foreshadows a potential turning point and an opportunity to "roll" into a long position when stopped out.

On the BUY side FADE and REVERSAL strategies off the 391-2 support pivot are qualified, however the FADE is a lower probability. REVERSALS off of this support can risk more but should also go for more profit with the expectation of a turning point "key reversal" signal to play out. BREAKOUT strategies above 404-2 are aggressive and should just "go" and not look back. Risk less and go for more. A laborious lackluster rise after a positive breakout is a sign that the MKT is more likely expanding its resistance lid for a new consolidation versus transition from negative to positive technical posture.

JS

This post supports the Strategy Based Trading, which is a methodology that focuses on the applied strategy verses a specific market. The approach looks to align strategies with markets whose current technical behavior matches the strategies criteria. Please review the following CME sponsored tutorial for a complete overview of this approach.

STRATEGY BASED TRADING Reviewhttp://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Wednesday, December 16, 2009

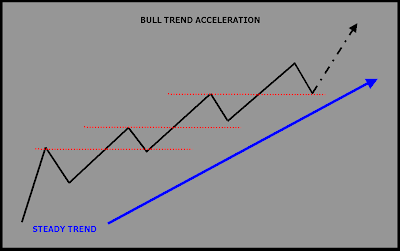

EuroStoxx H'10 - BULL TREND ACCELERATION

Technically the MKT is in a BULL TREND ACCELERATION posture and has produced a big positive signal. The MKT should maitain a trade above the 2883 Inflection Pivot and "run" to a new level if the signal is valid.

On the SELL side REVERSAL strategies can be executed at the 2971 and 3076 resistance levels following an exhaustive signal. Expectations should be for an immediate exhaustive turn with the MKT quickly moving away from the area. A gradual decline following a reversal signal and it is more likely just a pause before another round of buying, so lock in any unrealized gains. SELL FADE strategies against 2953 and 2971 have potential but wait for repeated tests, with the best opportunity not violating the resistance level. Consider rolling long on any stops with this strategy. SELL BREAKOUT strategies below 2883 are not recommended but can be used as a signal for a FADE against Directional resistance.

On the BUY side accept FADE, REVERSAL and BREAKOUT strategies above the 2883 Inflection Pivot. BREAKOUT strategies above 2953 early in the session may have issues holding structure, so respect any break in momentum. BUY FADE strategies off 2883 are recommended over REVERSAL strategies as the MKT is expected to hold higher structure and any failure should be considered a potential negative corrective shift. The MKT is aggressively bid which should keep pace throughout the session if the TREND ACCELERATION forecast is going to play out.

Note: The worst-case scenario for a MKT in this technical position is to go higher early in the session and then break all day. Be alert and recognize this. If you have > 3 loser long trades, consider taking the next sell signal, anticipating a corrective turn. Remember in this technical position if the MKT is going higher, it should just go. If not, there is the potential for a corrective break or digestive trading environment.

Tuesday, December 15, 2009

Australian Dollar H'10 - NEGATIVE SHIFT

Monday, December 14, 2009

NAT GAS - POSITIVE TRANSITION

The MKT is in a NEUTRAL TRANSITION technical posture with the potential for a positive turn. Opportunity exists on both sides however there is a better chance of acceleration to the upside if the integrity of the 5.134 Inflection Pivot remains intact.

On the SELL side avoid FADE strategies until after the 5.134 level has been broken to confirm a shift in momentum. Until then a better opportunity will be a REVERSAL strategy but only off the 5.440 resistance level. This is a one shot trade using a low risk big profit target criteria. The idea is that the transition trade is over and a negative shift back into a NEUTRAL DIGESTION is expected. SELL BREAKOUT strategies under 5.134 can be profitable but they are aggressive and should use the same aggressive position management as a REVERSAL. Risk less go for more.

On the SELL side avoid FADE strategies until after the 5.134 level has been broken to confirm a shift in momentum. Until then a better opportunity will be a REVERSAL strategy but only off the 5.440 resistance level. This is a one shot trade using a low risk big profit target criteria. The idea is that the transition trade is over and a negative shift back into a NEUTRAL DIGESTION is expected. SELL BREAKOUT strategies under 5.134 can be profitable but they are aggressive and should use the same aggressive position management as a REVERSAL. Risk less go for more.On the BUY side accept BREAKOUT, FADE and REVERSAL strategies with the expectation that the current negative to positive transition will continue. Keep aggressive position management on BREAKOUT strategies above 5.440 as the MKT is still in the neutral zone and has yet to commit to a new trend. A more conservative strategy would be to wait for negative reactions after a positive signal to FADE against 5.287 or 5.134. The trade should be fluid with the MKT immediately taking back lost ground after any downside squeeze.

Note: The MKT is trying to shift from a negative to a positive trend position. False starts and stops should be expected and position management adjustment anticipated, as quick momentum turns are the norm in this technical environment.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Saturday, December 12, 2009

FOREX - EURGBP - BEAR TREND ACCEELRATION SIGNAL

Key off the 9021 Inflection Pivot for an indication of the session tone and confirmation of the negative signal.

On the SELL side accept FADE, REVERSAL and BREAKOUT strategies against the 9021 Inflection Pivot and below the Friday's high at 9071. BREAKDOWN strategies should just "go" BELOW 8978, so do not risk much. FADE strategies are recommended over REVERSAL strategies as the MKT is expected to hold lower structure and any momentum shift should be considered a potential positive corrective turn.

On the BUY side avoid REVERSAL strategies off major support levels as these signals are more likely short squeeze rallies and opportunities to SELL into and FADE. BREAKOUT strategies above the 9021 are aggressive as it is a counter trend trade, so risk less and use smaller size. Any BUY FADE should have confirmation and are not recommended if the integrity of the 9021 Inflection Pivot level is intact. After a break in the negative structure is confirmed support levels can be used for short term reactions using aggressive position management.

Note: The MKT is in an aggressive sell posture. If the intergrity of the 9021 Inflection Pivot is intact its just a matter of time before the sellers try to overwhelm the MKT. Look for excuses to get short. If the 9021 level is breached opportunity will be on both sides of the MKT, however the bias still rests with the Bears.

Good Trading

JS

Strategy Based Trading is a methodology that focuses on the applied strategy verses a specific market and looks to align strategies with markets whose current technical behavior matches the strategies criteria. Please review the following CME sponsored tutorial for a complete overview of this approach.

STRATEGY BASED TRADING Reviewhttp://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Thursday, December 10, 2009

Positive Signal - DOW FUTURES H'10

Technically the MAR'10 DOW FUTURES is in a BULL TREND ACCELERATION posture and has produced a big positive signal. The MKT should "run" to a new level if the signal is valid.

On the SELL side REVERSAL strategies can be executed at the 10570 and 10686 extremes following an exhaustive signal. Expectations should be for an immediate exhaustive turn with the MKT quickly moving away from the area. A gradual decline following a reversal signal and it is more likely just a pause before another round of buying, so lock in any unrealized gains. SELL FADE strategies against 10416 and 10570 have potential but wait for repeated tests, with the best opportunity not violating the resistance level. Consider rolling long on any stops with this strategy. SELL BREAKOUT strategies below 10262 are not recommended but can be used as a signal for a FADE against Directional resistance at 10339.

Wednesday, December 9, 2009

CLEARBOX TM - Transparent Automated Trating Systems

http://www.jsservices.com/Clearbox/ClearboxIntro.wmv

CLEARBOXTM trading systems are transparent automated trading strategies. Automated strategies in which the trader understands the developer’s criteria and can run strategies that best fit a users trading plan. Traders have a portfolio of unique transparent buy and sell strategy templates that look to capture opportunity in specific market conditions and context. The CLEARBOXTM approach is a directed trade assist tool that provides hard entry and exit criteria with a users discretionary position and risk management.

The CLEARBOXTM Trading Systems are designed to provide an actionable knowledge based solution for both the professional and self-directed traders. The systems are completely automated but are ment to be used as a trading tool and be piloted by a trader not run as a “Blackbox”. Traders are advised to take either a Basic Money Mangement or Advanced Position Management approach when running the strategies. The strategies can be optimized using JS Services Price Map chart overlay to enhance position and risk management of the systems.

Please sign up for my webinar tommorrow Dec 10 AT 10AM CST.

Space is limited.Reserve your Webinar seat now at:http://www.strategyrunner.com/Registration/JSServices/Webinar.htm

JS

For more information please contact me at info@jsservices.com

Tuesday, December 8, 2009

BULL TREND ACCELERATION SIGNAL - Japanese Yen H'10 Futures

Technically the Mar'10 JAPANESE YEN contract is in a BULL TREND ACCELERATION posture after producing a big positive signal. The MKT should "run" to a new level if the signal is valid.

Key off the 11305 Inflection Pivot for a guide to the session sentiment.

On the SELL side REVERSAL strategies can be executed at the 11494 and 11588 resistance extremes following an exhaustive signal. Expectations should be for an immediate exhaustive turn with the MKT quickly moving away from the area. A gradual decline following a reversal signal and it is more likely just a pause before another round of buying, so lock in any unrealized gains. SELL FADE strategies at 11368 potential but wait for repeated tests, with the best opportunity not violating the resistance level. Consider rolling long on any stops with this strategy. SELL BREAKOUT strategies below 11242 are aggressive, with a better opportunity a FADE against the 11305 Infelction Pivot after a breakdown signal.

On the BUY side accept FADE, REVERSAL and BREAKOUT strategies above the 11179-11164 support area. BREAKOUT strategies above 11368 early in the session may have issues holding structure, so respect any break in momentum. BUY FADE strategies off 11242 are recommended over REVERSAL strategies as the MKT is expected to hold higher structure and any failure should be considered a potential negative corrective shift. The MKT is aggressively bid which should keep pace throughout the session if the TREND ACCELERATION forecast is going to play out.

Note: The worst-case scenario for a MKT in this technical position is to go higher early in the session and then break all day. Be alert and recognize this. If you have > 3 loser long trades, consider taking the next sell signal, anticipating a corrective turn. Remember in this technical position if the MKT is going higher, it should just go. If not, there is the potential for a corrective break or digestive trading environment.

Good Trading.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Monday, December 7, 2009

Dec 10, 2009 Webinar - Transparent Automated Trading Tools

CLEARBOXTM Trading Systems are transparent automated trading strategies. Automated strategies in which you understand the criteria and can run strategies that best fit a your trading plan. A portfolio of unique transparent buy and sell strategy templates that look to capture opportunity in specific market conditions and context are provided.

The CLEARBOXTM Trading Systems are designed to provide an actionable knowledge based solution for both professional and self-directed traders. The systems are completely automated but are ment to be used as a trading tool and be piloted by a trader not run as a “Blackbox”. Traders are advised to take either a Basic Money Mangement or Advanced Position Management approach when running the strategies. The strategies can be optimized using JS Services Price Map chart overlay to enhance position and risk management of the systems.

Title: An Introduction to the CLEARBOXTM Trading Systems

Date:

Thursday, December 10, 2009

Time:

10:00 AM - 11:00 AM CST

After registering you will receive a confirmation email containing information about joining the Webinar.

System RequirementsPC-based attendeesRequired: Windows® 2000, XP Home, XP Pro, 2003 Server, Vista

Macintosh®-based attendeesRequired: Mac OS® X 10.4 (Tiger®) or newer

Space is limited.Reserve your Webinar seat now at:http://www.strategyrunner.com/Registration/JSServices/Webinar.htm

Hope to see you there.

JS

Negative Signal needs confirmation - GOLD

Technically the MKT is in a BEAR TREND ACCELERATION and flirting with fresh losses with all trading below the 1171.4 Inflection Pivot.

The MKT has produced a big negative signal and any positive corrective action is expected to be short lived with only one upside "stop sweep" if the negative momentum is going to play out. Any held strength and repeated probe higher is a sign that the trade will turn digestive. This does not take away from the negative bias but does limit the profit potential for any new sales in the session.

On the SELL side accept FADE, REVERSAL and BREAKOUT strategies below the 1171.4 Inflection Pivot. BREAKOUT failures may need to be "worked" as the MKT is on edge and will be emotional, producing some starts and stops before it drops. FADE strategies are recommended over REVERSAL strategies as the MKT is expected to hold lower structure and any momentum shift should be considered a potential positive corrective turn.

On the BUY side avoid REVERSAL strategies off major support levels as these signals are more likely short squeeze rallies and opportunities to SELL into and FADE. BREAKOUT strategies above the 1171.4 Inflection Pivot are a long shot, so risk less and go for more. Any BUY FADE strategies off support should have confirmation and are not recommended if the integrity of the 1171.4 Inflection Pivot is intact. After a break in the negative structure is confirmed above 1171.4, major support levels can be used for short term reactions using aggressive position management.

Note: The MKT is on edge and is vulnerable to a big drop. If the 1171.4 Inflection Pivot has contained the buyers its just a matter of time before the sellers try to overwhelm the MKT. Look for excuses to get short. If the 1171.4 level is breached opportunity will be on both sides of the MKT, however the bias still rests with the Bears. 1088.6 is the lower target objective.

Good Trading.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Sunday, December 6, 2009

BEAR TREND ACCELERATION Signal - CORN H'10

Thursday, December 3, 2009

CORRECTIVE SIGNAL STATE - SP500 Index

Wednesday, December 2, 2009

BULL TREND DIGESTION - SP500 Index

*

- Trading below 1112.25 keeps the contract in a messy digestive trade down to 1104.25 and 1100. If the Index is going to maintain its composure it will stabilize above here. If not thing s can get a little slippery with 1084.50 and 1064 the low points for any new consolidation. 1039 is the extreme for any reversal of fortune in front of Friday's figure.

Be patient. If things don't get interesting quick the session could be another head banger.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Tuesday, December 1, 2009

BULL TREND ACCELERATION Signal - SP500

Key off the 1102 Inflection Pivot. This is the price point that determines the session bias. Above here the BULL TREND ACCELERATION signal is in play and the MKT aggressively bid. A breach of the recent highs at 1112.25 confirms the signal putting the Index on course for the 1132.75 and 1153.25 resistance targets.

Key off the 1102 Inflection Pivot. This is the price point that determines the session bias. Above here the BULL TREND ACCELERATION signal is in play and the MKT aggressively bid. A breach of the recent highs at 1112.25 confirms the signal putting the Index on course for the 1132.75 and 1153.25 resistance targets.Trading below 1102 lets some air out of the excitement down to 1091.75. This is the low point for any weakness today if the contract is going to maintain its composure. A break under 1091.75 negates yesterday's positive signal putting the MKT back in a difficult digestive trade with 1067 and 1047.50 targeted for any sentiment shift.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Price Map performance for Monday's post for DEC 1 2009. Note how a breach of the 1098.25 level sparked a rally up to the 1112.25 recent highs.

Dec'09 SP500 Index Dec1, 2009

Strategy Based Trading aligining your expectations with the MKTs current Technical State.

Strategy Based Trading aligining your expectations with the MKTs current Technical State.

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

Monday, November 30, 2009

NEUTRAL TRANSITION - SP500 Index

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Sunday, November 29, 2009

BULL TREND CORRECTION TECHNICAL STATE - GOLD, NAT GAS, 10YR T-NOTE, 5YR T-NOTE, Aussie$, DRG and IIX Sector Index

By developing a strategy to trade this state and apply only in MKTs that are producing negative signals against a positive trend or a BULL TREND CORRECTION, you not only improve your chances of a successful trade but also have a more satisfying trade experience as your strategy is align with your expectation.

* Practical Application review for Sep 21,2009 BULL TREND CORRECTION MKTs click here http://www.jsservices.com/recaps/JSSReviewUTC92109.wmv

For today, November 30 2009 - The following MKTs are in a BULL TREND CORRECTIVE state:

GC = GOLD Jan'10 - 1158.9 Inflection Pivot

NG = NAT GAS Jan'10 - 4.809 Inflection Pivot

TY = 10YR T-NOTE Mar'10 - 119-04 Inflection Pivot

FV = 5YR T-NOTE Mar'10 - 116-297 Inflection Pivot

DA = Australian Dollar Dec'09 - 9179 Inflection Pivot

DRG = Pharmaceutical Sector Index - 307 Inflection Pivot

IIX = Inter@tive Internet Sector Index - 22511 Inflection Pivot

The MKTs presented are "technically" in play, in a BULL TREND CORRECTIVE state, providing opportunity of both sides of the MKT. In this trend position it is more likely that the MKT is going to move than not. Typical scenarios are either 1. Downside follow through on the negative signal, 2. Positive reversal and resumption of the underlying Bull Trend or 3. Sideways neutral digest. By using the Inflection Pivot as a sentiment guide, [Bull Trend resumption above, Negative Correction Below] you can optimize your strategy performance and capitalize on this technical signal state.

Good Trading

JS

Strategy Based Trading is a methodology that focuses on the applied strategy verses a specific market and looks to align strategies with markets whose current technical behavior matches the strategies criteria. Please review the following CME sponsored tutorial for a complete overview of this approach.

STRATEGY BASED TRADING Reviewhttp://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Wednesday, November 25, 2009

CRUDE OIL - BEAR TREND ACCELERATION Signal

Tuesday, November 24, 2009

Recap:Nov 23, 2009 - SP500, DOW Futures, FTSE100

SP500 Dec'09 1095.50 Inflection Pivot

The Index started teh week in a negative corrective signal which remained in force below the 1095.50 Inflection Pivot. During Sunday evening's session the level was tested and then violated early Monday. The violation negated the negative signal and confirmed a resumption of the underlying positive trend providing a nice buy opportunity. This is a perfect example of a REVERSAL opportunity in the BULL TREND CORRECTION technical signal.

The Index started teh week in a negative corrective signal which remained in force below the 1095.50 Inflection Pivot. During Sunday evening's session the level was tested and then violated early Monday. The violation negated the negative signal and confirmed a resumption of the underlying positive trend providing a nice buy opportunity. This is a perfect example of a REVERSAL opportunity in the BULL TREND CORRECTION technical signal.DOW Futures Dec'09 10349 Inflection Pivot

The DOW provided a similar opportunuty breaking out above it's Inflection Pivot in the early Monday hours. This is why I like this signal state so much. It is dynamic and provides a great opportunity to get back on the underlying trend and favorable prices. Here even coming in at the regular session the violation of the 10412 JS Services initial target level provided a nice pop up to the 2nd target.

The DOW provided a similar opportunuty breaking out above it's Inflection Pivot in the early Monday hours. This is why I like this signal state so much. It is dynamic and provides a great opportunity to get back on the underlying trend and favorable prices. Here even coming in at the regular session the violation of the 10412 JS Services initial target level provided a nice pop up to the 2nd target.FTSE100 Dec'09 5313 Inflection Pivot

The FTSE100 was the best opportunity as its REVERSAL buy signal happened during the regular session and was combined with an Upside Pivot [UP] breakout signal attaining the 2nd Upside Target [UT2] in the session.

The FTSE100 was the best opportunity as its REVERSAL buy signal happened during the regular session and was combined with an Upside Pivot [UP] breakout signal attaining the 2nd Upside Target [UT2] in the session.This is the Strategy Based Trading approach at work. Our expectations where for the MKT to key off the session Inflection Pivot to confirm or deny the negative technical corrective signal. Once the Inflection Pivot was breached market sentiment shifted back to the underlying posiitve trend producing a fresh buy opportunity.

The charts presented show JS Services Price Map overlay. Sign up for a Complimentary FREE Trial

Good Trading

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

Sunday, November 22, 2009

BULL TREND CORRECTION Signals for : SP500, DOW Futures, FTSE 100

Today we are going to focus on MKTs that have produced a negative signal against an underlying positive trend or a BULL TREND CORRECTION signal state. A dynamic technical state with opportunity on both sides of the market.

The question, is this negative signal going to follow through or is this just a 1 day event and the underlying positive momentum is going to resume. The price point that answers this question and determines this "sentiment shift" is the session Inflection Pivot. This is the price point that defines the technical state from being a negative "corrective"posture below that price point to a positive BULL TREND position above that price point.

Trading below the session Inflection Pivot is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

For November 23, 2009 the following MKTs are in a BULL TREND CORRECTIVE state and the Inflection Pivot that determines the contiuation of the sell signal or a reversion to the underlying positive trend.

EQUITY FUTURES [DEC09]

SP500 1095.50

Dow Futures 10349

FTSE100 5313

Draw a line on your intra-day chart at these levels. Look for opporunty in the direction of the price bias. Executing at or near these price points will provide the best risk / reward. SELL FADE and BUY BREAKOUT should be considered as entry strategies at these levels.

Good Trading.

JS

Strategy Based Trading is a methodology that focuses on the applied strategy verses a specific market and looks to align strategies with markets whose current technical behavior matches the strategies criteria.STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial

Thursday, November 19, 2009

NAT GAS - BEAR TREND CORRECTION

A break under 4.192 and the BEARS are back probing lower with 4.002 and 3.865 the initial targets for any resumption of the negative momentum. 3.663 is the extended target.

Good Trading

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Wednesday, November 18, 2009

NAT GAS - BEAR TREND ACCELERATION Signal

In the NAT GAS Z'09 for today 4.332 is the Inflection Pivot

BEAR TREND ACCELERATION technical state is an excited state. The MKT is fearful, almost in a panic. Any positive turn out of that state will be a big “relief” and buyers will scramble to “re balance” sometime sparking a sharp advance. If the MKT continues to hold negative structure emotional selling is expected to continue.

NAT GAS Dec'09 for November 19, 2009

Technically the MKT is in a BEAR TREND ACCELERATION position and is vulnerable to the offer. Any positive corrective action is expected to be short lived with only one upside "stop squeeze" if the negative momentum is going to play out. Any held strength and repeated probe higher is a sign that the trade will turn digestive. This does not take away from the negative bias but does limit the profit potential for any new sales in the session.

On the SELL side accept FADE, REVERSAL and BREAKOUT strategies below the previous sessions high point. BREAKOUT strategies should just "go", so do not risk much. FADE strategies are recommended over REVERSAL strategies as the MKT is expected to hold lower structure and any momentum shift should be considered a potential positive corrective turn.

On the BUY side avoid REVERSAL strategies off major support levels as these signals are more likely short squeeze rallies and opportunities to SELL into and FADE. BREAKOUT strategies above the previous session high are a long shot, so risk less and go for more. Any BUY FADE should have confirmation and are not recommended if the integrity of the previous session high is intact. After a break in the negative structure confirmed support levels can be used for short term reactions using aggressive position management.

Note: The MKT is in an aggressive sell posture. If the previous session high is intact its just a matter of time before the sellers try to overwhelm the MKT. Look for excuses to get short. If the previous session high is breached opportunity will be on both sides of the MKT, however the bias still rests with the Bears.

Good Trading

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Tuesday, November 17, 2009

NAT GAS Z'09 - Signal Review

As expected the signal was a false positive rejecting from the 4.722 Inflection Pivot. Below is the session performance with JS Services R LEVEL identifying the session Inflection Pivot. Note how the Price Map as a whole defined the market structure for the session.

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Good Trading

JS

Monday, November 16, 2009

NAT GAS Z'09 - BEAR TREND CORRECTION Signal

For today, November 17, 2009 - The following MKT is in a BEAR TREND CORRECTIVE state:

Sunday, November 15, 2009

EUREX BUND - Neutral Negative Shift

STRATEGY BASED TRADING http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

NEUTRAL NEGATIVE SHIFT

NOV 16, 2009

EUREX BUND Z'09 - 12161 Inflection Pivot

DEC'09 EUREX BUND - Technically the MKT is in a NEUTRAL DIGESTIVE position with a negative bias. Opportunity exists on both sides of the MKT but selling strength is the better opportunity.

On the SELL side accept FADE, BREAKOUT and REVERSAL strategies off major inflection points. SELL BREAKOUT strategies should just "go" and not look back, so keep risk parameters tight. FADE strategies after a negative breakdown signal are good opportunities as well but expectation should be for the MKT to quickly move back under the failed support. If the trade just "hangs around" is more likely a signal that more digestive action is coming and a retest of resistance should be expected. Be more aggressive with FADE and REVERSAL strategies at or against the previous session high point targeting the opposing digestive support. Above the previous session high point enterying after the 2nd or 3rd press into an area is recomended over stepping in front of the initial challenge.

On the BUY side BREAKOUT strategies are aggressive and should be entered sooner [lower] than later [higher]. Expectations should be for the MKT to make its move early in the session and not look back, holding strucutre most of the day. If the MKT digests prior to making a positive move it is more likely a short squeeze to FADE. BUY FADE strategies are aggressive and if they are going to work should do so on the initial test of support. Repeated tests or "confirmation" are more likely to give way to a lower trade. BUY REVERSAL strategies are recommended off the session initial major support only, as the MKT is vulnerable to a negative trend shift. The probability is to the downside today so don't get stubborn buying breaks.

Note: The MKT is in neutral so "sloppy" conditions with "false signals" should be anticipated. Have a plan for any squeeze. Don't get stubborn however if the MKT starts to hold structure and gets into trend mode as the contract may just be expanding its digestive parameters producing a one way trade into the close and new extreme.

For an overview on ENTRY strategies please review the following linkhttp://www.jsservices.com/education/sbt/CME_EntryStrategies5min.wmv

Good trading.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Thursday, November 12, 2009

EuroFX Z'09 - Negative Signal needs confirmation

Wednesday, November 11, 2009

BULL TREND ACCELERATION Signals

Tuesday, November 10, 2009

BULL TREND ACCELERATION SIGNALS

The following markets have produced a positive signal and will continue to work an aggressive buy posture above their session Inflection Pivot.

BULL TREND ACCELERATION

NOVEMBER 11, 2009

MKT - Inflection Pivot

SP500 Z'09 - 1069.25

ND100 Z'09 - 1752.25

Dow Futures Z'09 - 10139

Canadian$ Z'09 - 9432

Mexican Peso z'09 - 7455

BOBL Z'09 - 115.46

Draw a line on your intra-day chart at these levels. Look for opportunity in the direction of the Inflection Pivot price bias. Executing at or near these price points will provide the best risk / reward. If the MKT cannot follow through on its signal and produces a REVERSAL signal at its Inflection Pivot, a sharp counter signal move should be expected.

Good trading.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Monday, November 9, 2009

BIG POSITIVE -BULL TREND ACCELERATION SIGNALS

MKTs that we are covering producing a negative signal. We did however get more than a few positive signals. Below are MKTs that have produced a major positive signal are in a BULL TREND ACCELERATION technical state. Expectation is that the signal is going to follow through as long as the signal is in line with the MKTs Inflection Pivot. So BULL TREND ACCELERATION should hold above their session Inflection Pivot if the signal is going to remain valid.

MKTs that we are covering producing a negative signal. We did however get more than a few positive signals. Below are MKTs that have produced a major positive signal are in a BULL TREND ACCELERATION technical state. Expectation is that the signal is going to follow through as long as the signal is in line with the MKTs Inflection Pivot. So BULL TREND ACCELERATION should hold above their session Inflection Pivot if the signal is going to remain valid.The strategies presented are in line with JS Services Strategy Based Trading approach, which looks to align the markets current technical state with your applied strategy criteria.

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For November 10, 2009

BULL TREND ACCELERATION

The markets below have produced a major positive signal which should follow through today if valid. Key off the session Inflection Pivot for an indication of the market structure and confirmation that the aggressive positive signal is in play.

Equity Indices Dec'09 Inflection Pivot

DAX - 5546

EuroSTOXX - 2799

FTSE 100 - 513.20MidCap400 - 678.10

ETF

XAL -24.85

BTK - 889.65

DJU - 372

XOI - 1090

OSX - 197.00

Interest Rate

BOBL - 115.33

Energy

Heating Oil - 20407

FOREX

AUDJPY - 82.93

Draw a line on your intra-day chart at these levels. Look for opportunity in the direction of the price bias. Executing at or near these price points will provide the best risk / reward. If the MKT cannot follow through on its signal and produces a REVERSAL signal at its Inflection Pivot, a sharp counter signal move should be expected.

Good trading.

JS

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Sunday, November 8, 2009

TREND ACCELERATION SIGNALS for NOV 9, 2009

For November 9, 2009

BULL TREND ACCELERATION

The markets below have produced a major positive signal which should follow through today if valid. Key off the session Inflection Pivot for an indication of the market structure and confirmation that the aggressive positive signal is in play.

Currencies Futures Dec'09

JAPANESE YEN - 11038

AUSTRALIAN DOLLAR - 9102

Interest Rates Dec'09

US 10YR T-NOTE - 118-160

EQUITY ETF

SPY - SP500 Depository Receipts - 107.53

QQQ - NASDAQ 100 Tracking Stock- 41.97

RLX - Retail Sector Index - 389.00

IIX - Inter@ctive Internet Sector Index - 217.00

BEAR TREND ACCELERATION

The markets below have produced a major negative signal which should follow through today if valid. Key off the session Inflection Pivot for an indication of the market structure and confirmation that the aggressive negative momentum is in play.

Interest Rate Dec'09

BUND - 12089

Commodities Jan'10

SOYBEANS - 975-4

Draw a line on your intra-day chart at these levels. Look for opportunity in the direction of the price bias. Executing at or near these price points will provide the best risk / reward. If the MKT cannot follow through on its signal and produces a REVERSAL signal at its Inflection Pivot, a sharp counter signal move should be expected.

Good trading.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Thursday, November 5, 2009

BEAR TREND ACCELERATION REVIEW - SWISS FRANC Z'09

Expectations are that if the negative signal is going to follow through the MKT will remain below the price point. A rise above this price and sentiment shifts.

A BEAR TREND ACCELERATION technical state is an excited state. The MKT is fearful, almost in a panic. Any positive turn out of that state will be a big “relief” and buyers will scramble to “rebalance” sometime sparking a sharp advance.

This is what played on in the SWISS FRANC Z’09 yesterday. The MKT could not follow through on its technical signal and after a breach in the negative structure a sharp rally was produced.

This is the power of strategy based trading, aligning your expectations with the MKTs current technical state. Your expectation in a BEAR TREND ACCELERATION technical state is that the MKT is going to “fall out of bed”. If this does not play out and the signal is “invalid” a counter positive reaction should be expected. The price point that defines this sentiment shift is what I call the Inflection Pivot.

This is the power of strategy based trading, aligning your expectations with the MKTs current technical state. Your expectation in a BEAR TREND ACCELERATION technical state is that the MKT is going to “fall out of bed”. If this does not play out and the signal is “invalid” a counter positive reaction should be expected. The price point that defines this sentiment shift is what I call the Inflection Pivot. Hope this helps.

Good trading.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

Tuesday, November 3, 2009

SWISS FRANC Z'09 - BEAR TREND ACCELERATION

For November 4, 2009 only the Swiss Franc Dec'09 futures have produced a BEAR TREND ACCELERATION signal.

Swiss Franc Z'09 9767 Inflection Pivot

The question, is does this signal have potential or was yesterday's signal just a 1 day event. The price point to key off that keeps the MKT in an aggressive sell posture is the 9767 Inflection Pivot. This is the price point that defines the technical state from being an aggressive sell posture below that price point to a potential reversal or digestive trade above that price point.

If the MKT is bad it should hold below 9767 and press the 9697 initial support level. If we are in for a digestive session the contract will stabilize here. A held failure confirms yesterday's negative signal targeting 9627 on any release. 9487 is the current extreme.

A held rise above 9767 takes the edge off the currency for a difficult trade up to 9802 with the potential of going as high as 9837 in the session. No follow through is expected. Only above 9837 does sentiment shift projecting the MKT up to 9977.

Draw a line on your intra-day chart at these levels. Look for opportunity in the direction of the Inflection Pivot bias. Executing at or near these price points will provide the best risk / reward.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.