- Technically the MKT is "on the fence" with the potential to go in either direction or nowhere. Pick your points and have no expectations, as the likelihood of this MKT trading sideways is high.

- On the SELL side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The pivotal nature of the session does have the potential to be the starting point for a new move. However, the probability of any trend action is more likely to just be the MKT defining its new consolidation extreme.

- On the BUY side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The MKT is "on the fence" and does have the potential to be the beginning of a new trend move. The probability of a new trend move is low. However, any price trend action is more likely to just be the MKT defining its new consolidation extremes.

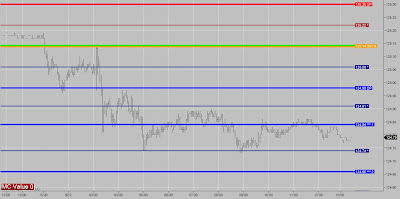

Today's PRICE MAP Performance for BOBL

- With an MC Value of 0 and a NEUTRAL DIGESTION state, the market is "on the fence". The BOBL opened the day below the R Level which indicating that traders should look for SELL signals below the R Level. Just before midnight, the market met support at the DP. From here, the market advanced throughout the early morning and tested the DIR just after 3:00 A.M. This was the key moment in today's trading, as a failure from the R would validate that level and signal to the trader to short the market. Price action respected the R Level perfectly and gave our traders an opportunity to execute a SELL DIR FADE strategy. Ideally our profit target would be two major Price Map levels from our entry, giving us a target of the UT1; however, in a NEUTRAL market, expectations are for a choppy trade, and the DP would be a safer exit point. As it played out, the market blew through the DP and did in fact make it all the way down to our ideal profit target at the UT1. After finding support at the 124.84 level, the market rallied back up to the DP. The market failed twice to surpass this level which signaled that the market was defining a new digestive range below the DP.