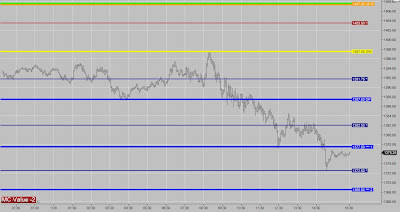

-The MKT has a slight negative bias in a difficult “choppy”

trade. On the SELL side DP BREAKOUT

strategies are valid but should expect a laborious trade. UP and UT1 FADE and REVERSAL strategies are recommended

but profit should be taken at initial targets.

The probability is to the downside but is not a day to press it.

-On the BUY side avoid UP BREAKOUT strategies but rather

FADE a negative reaction after a positive breakout signal at the DIR. DP REVERSAL strategies are recommended over

FADE strategies as “sloppy” trading conditions are expected. Any DP FADE trades should get confirmation

before executing. Position management

adjustments should be anticipated for all longs as sideways trading conditions

can quickly erase profits.

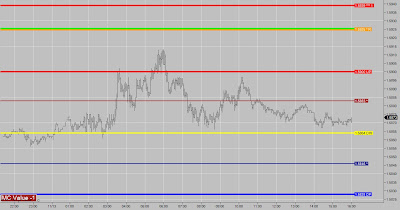

Today's PRICE MAP Performance for BP- With an MC Value of -1 we have a slight negative bias on a NEUTRAL trading environment. With the R Level at the minor target above the UP, the analyst has expanded the Critical Range and identified the minor level above the R Level to be the "breaking point" for the negative bias. Consistant with out market commentary, we get a SELL UP REVERSAL strategy when the market fails to sustain its breakout from the UP. Our market commentary tells us to take profits at our initial target, so profits should be realized at the DIR around 8:30 AM.