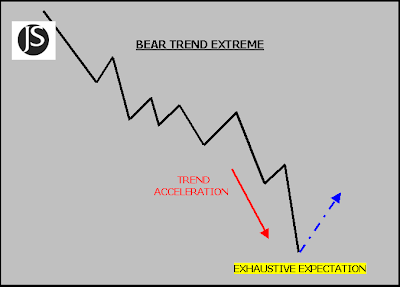

Technically the MKT is in a BEAR TREND ACCELERATION position and is vulnerable to the offer. Any positive corrective action is expected to be short lived with only one upside "stop squeeze" if the negative moemtnum is going to play out. Any held strength and repeated probe higher is a sign that the trade will turn digestive. This does not take away from the negative bias but does limit the profit potential for any new sales in the session.

Key off the 5949 Inflection Pivot today. This is the top the market's BEAR TREND structure and the high point for any upside squeeze if the negative signal is going to retain its influence.

On the SELL side accept FADE, REVERSAL and BREAKOUT strategies below the 5949 level. BREAKOUT strategies below 5812.5 should just "go", so do not risk much. FADE strategies are recommended over REVERSAL strategies at 5881 and 5949 as the MKT is expected to hold lower structure and any momentum shift should be considered a potential positive corrective turn.

On the BUY side avoid REVERSAL strategies off major support levels as these signals are more likely short squeeze rallies and opportunities to SELL into and FADE. BREAKOUT strategies above 5881 and 5949 are a long shot, so risk less and go for more. Any BUY FADE off the 5812.5 support pivot should have confirmation and are not recommended if the integrity of the previous session high is intact. After a break in the negative structure confirmed support levels can be used for short term reactions using aggressive position management.

Note: The MKT is in an aggressive sell posture. If the previous session high is intact its just a matter of time before the sellers try to overwhelm the MKT. Look for excuses to get short. If the previous session high is breached opportunity will be on both sides of the MKT, however the bias still rests with the Bears.

JS

Key off the 1132.50 Inflection Pivot for an indication of the sessions immediate tone. Use this as an "over under" number today. Above here the

Key off the 1132.50 Inflection Pivot for an indication of the sessions immediate tone. Use this as an "over under" number today. Above here the