Today's MARKET STATE for S&P 500: **NEUTRAL DIGESTION TRANSITION**

- MKT sentiment is leaning negative and will outweigh the

buy side if the integrity of the previous session high remains intact.

- On the SELL side accept BREAKOUT, FADE and REVERSAL

strategies with the expectation that the current negative transition will

continue. Keep aggressive position

management on DP BREAKOUT strategies as the MKT is still in the neutral zone

and has yet to commit to a new trend. A

more conservative strategy would be to wait for positive reactions after a

negative signal to FADE the DIR.

- On the BUY side avoid DP FADE strategies until after the

previous session high point has been taken out.

Until then, a better opportunity will be a DP REVERSAL strategy. The idea is that the transition trade is over

and a positive shift back into a NEUTRAL DIGESTION is expected. UP BREAKOUT strategies can be profitable but

they are aggressive. Risk less, go for

more.

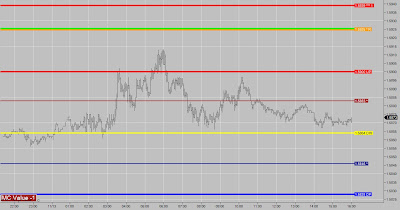

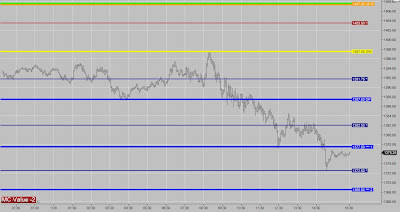

Today's PRICE MAP Performance for SP

Wrap Up

- Today the S&P 500 market performed to market expectations and followed through on the negative transitional signal. The R Level at the UP represented the breaking point for the negative transitional signal. With price action failing to break above this level, the negative signal remained in play and the opportunity for the session is to the downside. The market sold off to the DP in the overnight session signaling to traders that the markets wanted to transition lower. After finding support at the DP around 4:00 AM, the market rallied back up to our DIR giving us an opportunity to execute a SELL DIR FADE strategy from this level around 8:45 this morning. this proved to be the trade of the day as the market sold off sharply, digesting for a minute at the DP before transitioning down to our next major level at the DT1.