- The MKT is in neutral, working a slight positive bias

against a negative underlying trend. Opportunity exists on both sides of the

MKT. However, the threat of the return of the negative momentum must be

respected.

- On the SELL side accept BREAKOUT, FADE and REVERSAL

strategies off major inflection points with the expectation that the negative

momentum is going to resume. DP SELL BREAKOUT strategies can risk a little more

of current events and other MKTs of confluence confirm a negative posture.

- On the BUY side DP FADE strategies are valid, however the

underlying momentum remains negative and any long opportunity is short term. DP

BUY REVERSAL strategies should be avoided, as any break in momentum is a sign

that the BEAR TREND is ready to resume. UP BUY BREAKOUT strategies are

aggressive and the better opportunity is a DIR FADE after a positive breakout

signal.

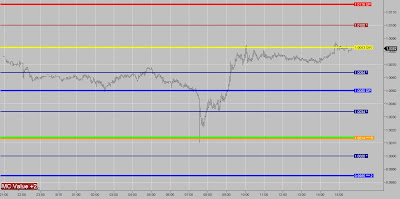

- A MC Value of +2 and an R at the DT1 set the stage for the positive Sentiment Bias for today's action in the CANADIAN DOLLAR. The Market State warns of a possible decline; however, by placing the R Level at the DT1 the analyst is telling the trader that above that level, the expectation is for a move higher. There was an emotional sell off just after 7 AM that brought prices down below the R for a brief moment. Prices then rallied sharply back to the minor level, where they digested for about an hour. The opportunity existed for what would have been a BUY R REVERSAL strategy. Although price action only penetrated through the R for a brief moment before rallying, the penetration and rally back through this level presented the trader an opportunity to go long, which eventually proved to be a very profitable trade. The market rallied above the minor level, found support at this level around 8:30 AM, and then began another sharp rally. This rally took prices all the way up to the DIR at 10 AM where profits should have been realize on a well executed trade.

No comments:

Post a Comment