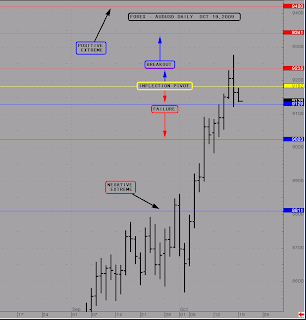

Today we are going to focus on MKTs that have produced a major negative signal BEAR TREND ACCELERATION. This is a big negative that should accelerate the current downside momentum if valid. The question, is does this signal have potential or was yesterday's signal just a 1 day event. The price point to key off that keeps the MKT in an aggressive sell posture is the session Inflection Pivot. This is the price point that defines the technical state from being an aggressive sell posture below that price point to a potential reversal or digestive trade above that price point.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level has the MKT in an aggressive posture and the BEAR TREND ACCELERATION signal in play. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance of a sharp positive push of firm digestive trade.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level has the MKT in an aggressive posture and the BEAR TREND ACCELERATION signal in play. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance of a sharp positive push of firm digestive trade.October 29, 2009

Below are the MKTs that have produced a BEAR TREND ACCELERATION signal and the Inflection Pivot that determines the continuation of the sell signal or not.

EQUITY FUTURES [DEC09]

SP500 1051.75

Dow Fut 9702

Nasdaq100 1672.25

CURRENCIES

Canadian Dollar z'09 9341

AUDUSD FOREX 9020

EURGBP FOREX 9003

Draw a line on your intra-day chart at these levels. Look for opportunity in the direction of the price bias. Executing at or near these price points will provide the best risk / reward.

If the current price is above the Inflection Pivot the the current sentiment is like "prove it to me". If the MKT cannot break under the Inflection Pivot the likely hood that yesterday's signal day was a 1 day event and the potential for a corrective rally is high. If the Inflection Pivot is above the MKT then the negative signal is in play "up" to that price point. Any lower sales are not "wrong" unless the MKT is above the Inflection Pivot and sell signal below this point should be taken.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

click the image to enlarge

click the image to enlarge