FAZ AS AN EVENT HEDGE

The FAZ Financial Bear 3x is a short-term [read Daily rebalancing] timing tool that can be used as a hedge for a potential event day.

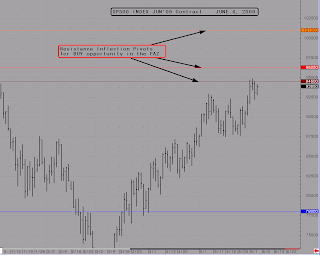

With Employment numbers released tomorrow and the SP500 Index at a major inflection pivot [945] the FAZ can be a good value “insurance” bet.

Buying the FAZ this afternoon or near the close and exiting tomorrow or Monday’s close.

The SP500 JUN’09 contract is currently keying off the 945 and 962.50 Inflection Pivots. Buying the FAZ on a 1 and 2 unit size ratios, 1 unit at 945 and 2 units when the SPM’09 is at 962.50.

If the recent rally is going to fizzle and turn sour it will do so off either of these inflection points and if so put the Index back in a vulnerable position with the potential to put the lower Bear trend pattern back in play for a revisit to the April’09 lows at the 780 area. Not in the session mind you but as a psychological sentiment shift that this could be so, with the expectations displayed in the price of the FAZ.

A rise above 962.50 and the Index will have another 40-50pts in it for a challenge to the 1010 level. This will be another opportunity to buy FAZ, as even a small reaction here should pay for any losses incurred on the original FAZ buys. Consider using the 3.5pt stop at each SP M’09 inflection point for any FAZ buys. Each inflection pivot level can be used with a REVERSAL strategy if stopped out as well as any violation of resistance should be sustained and hold structure if the MKT is good.

Looks like a 1 to 8 risk reward, which it should be as this is a counter trend FADE.

Insurance is not cheap but this has the potential to make something for you.

945, 962.50 and 1010 Inflection pivots. 1 unit, 2 unit and 3 unit respective opportunities. Remember the FAZ rebalances each day so pushing a position beyond a couple sessions is too much.

The best option is to use the JS Services Price Map each day to isolate the key session inflection points to leverage opportunity in the FAZ.

The FAZ Financial Bear 3x is a short-term [read Daily rebalancing] timing tool that can be used as a hedge for a potential event day.

With Employment numbers released tomorrow and the SP500 Index at a major inflection pivot [945] the FAZ can be a good value “insurance” bet.

Buying the FAZ this afternoon or near the close and exiting tomorrow or Monday’s close.

The SP500 JUN’09 contract is currently keying off the 945 and 962.50 Inflection Pivots. Buying the FAZ on a 1 and 2 unit size ratios, 1 unit at 945 and 2 units when the SPM’09 is at 962.50.

If the recent rally is going to fizzle and turn sour it will do so off either of these inflection points and if so put the Index back in a vulnerable position with the potential to put the lower Bear trend pattern back in play for a revisit to the April’09 lows at the 780 area. Not in the session mind you but as a psychological sentiment shift that this could be so, with the expectations displayed in the price of the FAZ.

A rise above 962.50 and the Index will have another 40-50pts in it for a challenge to the 1010 level. This will be another opportunity to buy FAZ, as even a small reaction here should pay for any losses incurred on the original FAZ buys. Consider using the 3.5pt stop at each SP M’09 inflection point for any FAZ buys. Each inflection pivot level can be used with a REVERSAL strategy if stopped out as well as any violation of resistance should be sustained and hold structure if the MKT is good.

Looks like a 1 to 8 risk reward, which it should be as this is a counter trend FADE.

Insurance is not cheap but this has the potential to make something for you.

945, 962.50 and 1010 Inflection pivots. 1 unit, 2 unit and 3 unit respective opportunities. Remember the FAZ rebalances each day so pushing a position beyond a couple sessions is too much.

The best option is to use the JS Services Price Map each day to isolate the key session inflection points to leverage opportunity in the FAZ.

For more information please contact me at info@jsservices.com

JS

No comments:

Post a Comment