BRITISH POUND – Initial Target Attained

In my May 20, 2009 post, with the JUN’09 BRITISH POUND contract trading at the 15663 Inflection Pivot, I highlighted a positive divergence signal with a 16633 initial target.

Impressive day in the British Pound.

15663 is the Inflection Pivot to key off for the current advance. If the MKT is going to run it should just go with 16363 and 16633 the initial targets.

Today the MKT attained that target.

By using the Price Map you optimized your position by not only locking in your gains but were also presented an opportunity to get short.

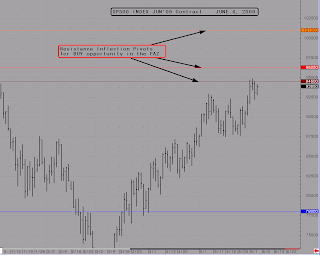

The service is published at 12am cst and highlighted the MKTs technical position to be “BULL TREND EXTREME”. In this technical state the MKT is extended and an exhaustive reaction is expected.

At 1am cst the MKT was at our forecasted target, which was also today’s UP [Upside Pivot or Resistance Inflection Pivot]. With the technical posture exhaustive, taking profits at 16634 was the only option. If you were not on the MKT, a resting overnight order was a nice wake up call.

But the day is just getting started and on the right foot. On the regular session open the Price Map produces a negative signal below the DIR [16542] providing a sell opportunity. Additionally a failure from the 16420 DP [Downside Pivot or Support Inflection Pivot] provides another sell signal with two opportunities to enter and attaining the 16266 DT2 [Downside Target #2].

This is a classic Price Map BREAKOUT strategy. Where the MKT breaks outside the UP-DP Critical Range extremes.

The original May 20, 2009 post signal was valid for a 1000 point move. The Price Map enhanced this with another 800-point winner on the reverse.

This is the power of Strategy Based Trading.

Aligning your strategy with the market expectations.

Today JS Services Technical Outlook was BULL TREND EXTREME. Our expectations are for an exhaustive reversal or digestive trade. Combining this with our long term forecast target we can anticipate a negative reaction and accept exhaustive Reversal and Breakdown Failure signals.

By using the sell bias Price Map entry strategies at risk qualified inflection points we can systematically exploit this opportunity.

By anticipating opportunity we capture it.

For more information regarding Strategy Based Trading and the Price Map please contact me.

JS