Today's MARKET STATE for S&P 500 INDEX: **BULL TREND**

- The MKT has a firm tone and as long as the integrity of the previous session low remains intact, look for excuses to get long. On the SELL side UP FADE strategies are valid but profit targets and risk management should be tight. REVERSAL strategies should be applied only at the UP and +c after an exhaustive signal. Use DP BREAKOUT strategies as a signal to FADE a positive reaction against the DIR. Only until the MKT breaks the positive structure are sell signals an opportunity.

- On the BUY side BREAKOUT, FADE and REVERSAL are recommended as the MKT is bid and all buy signals are valid opportunity. If stopped out at or near the low tic of a reaction and the MKT is not following through to the downside, look to re-enter using the recent squeeze low as a stop. If the MKT breaks structure, de-leverage and be more selective as the likelihood of a sideways trade is high.

Today's PRICE MAP Performance for SP

Wrap Up

- Today in the S&P 500 INDEX market, JS Services helped its traders position themselves on the correct side of the market to capture profits from the emotional rally that came from the Fed announcement. An MC value of +7 and a BULL TREND Market State provided the framework for today's trading...BUY! After a dull digestive period to start the day, the market began to rally just after 11:30 A.M. From here, our market commentary suggests a BUY UP BREAKOUT trade with the expectation that the market will produce a move higher. The market rallied violently up to the UT1, took a breath, and then continued up to our profit target, the UT2, just after 12:30. Although we recommend realizing profits at the 2nd major price map level from the order entry point, a trader who'd held on to their position would have been rewarded handsomely, as the market traded all the way up to, and through, our 2nd minor level at 1455.00. Trading with the JS Services Strategy Based Trading approach would have positioned you on the correct side of the market and led to SERIOUS profits today.

Today's MARKET STATE for EURO-BOBL: **NEUTRAL DIGESTION**

- Technically the MKT is "on the fence" with the potential to go in either direction or nowhere. Pick your points and have no expectations, as the likelihood of this MKT trading sideways is high.

- On the SELL side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The pivotal nature of the session does have the potential to be the starting point for a new move. However, the probability of any trend action is more likely to just be the MKT defining its new consolidation extreme.

- On the BUY side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The MKT is "on the fence" and does have the potential to be the beginning of a new trend move. The probability of a new trend move is low. However, any price trend action is more likely to just be the MKT defining its new consolidation extremes.

Today's PRICE MAP Performance for BOBL

Wrap Up

- With an MC Value of 0 and a NEUTRAL DIGESTION state, the market is "on the fence". The BOBL opened the day below the R Level which indicating that traders should look for SELL signals below the R Level. Just before midnight, the market met support at the DP. From here, the market advanced throughout the early morning and tested the DIR just after 3:00 A.M. This was the key moment in today's trading, as a failure from the R would validate that level and signal to the trader to short the market. Price action respected the R Level perfectly and gave our traders an opportunity to execute a SELL DIR FADE strategy. Ideally our profit target would be two major Price Map levels from our entry, giving us a target of the UT1; however, in a NEUTRAL market, expectations are for a choppy trade, and the DP would be a safer exit point. As it played out, the market blew through the DP and did in fact make it all the way down to our ideal profit target at the UT1. After finding support at the 124.84 level, the market rallied back up to the DP. The market failed twice to surpass this level which signaled that the market was defining a new digestive range below the DP.

Today's MARKET STATE for DJI FUTURE INDEX: **BULL TREND CORRECTION**

- The MKT has a soft tone against an underlying positive trend. On the SELL side accept UP FADE signals on the 1st or 2nd press into the area only. REVERSAL strategies should only be done off the UP or the previous session high point and will immediately work if they are going to. Keep position and risk management tight on these trades. SELL DP BREAKOUT strategies are aggressive but do have potential to be the start of a larger corrective turn. Keep risk management tight.

- On the BUY side accept REVERSAL signals off all major inflection levels, expecting the underlying positive momentum to resume. DP FADE strategies will work better with confirmation as the MKT is in a corrective state and will be probing lower looking for soft spots. Work any BUY DIR and UP BREAKOUT strategies as any positive shift in momentum has the potential to be the start of the next leg higher. DIR FADE strategies after the UP Breakout should use greater leverage.

Today's PRICE MAP Performance for YM

Wrap Up

- Today in the DJI FUTURES INDEX we had a MC Value of +2 and a BULL TREND CORRECTION Market State. This state tells us that the market has produced a corrective signal; however, the underlying trend is positive and must be respected. With the R Level at the DIR, a breach above this level has the potential to be the start of the next move higher. Around 1 A.M. the market tested the DIR in a tight digestive zone, after retreating briefly, the BUY DIR BREAKOUT signal was given to get long the market just after 1:30. The trade wasted no time in advancing up through the minor level, above which the market digested for the greater portion of the morning session. The minor level held support 4 times throughout the morning session, until finally, after testing the UP 3 times, the market broke out of the Critical Range just after 8:30 A.M. After rallying up to the next minor level at 13324, the market paused to take a breath, and eventually made it all the way up around 13350. Although our profit target at the UT1 was not attained, stops should have been tightened on the way up, and if a trader hadn't closed the position around 13350, profit give-back should have been minimized by tightened stops on the trade.

Today's MARKET STATE for S&P 500 INDEX: **BULL TREND ACCELERATION EXTREME**

- Technically the MKT has produced a big positive technical shift signal and will need to hold structure if it is going to avoid a drop back into a digestive trade. On the SELL side UP FADE signals are valid but REVERSALS are a better option. Use resting profit limits and tight stops. DIR and DP BREAKOUT strategies are aggressive but do have the potential to profit from a quick negative move out of the extreme. Use tight position management as any unrealized profits can be erased quickly.

- On the BUY side accept DP FADE signals after confirmation. The MKT is extended and may search for stops before it resumes its Bull move. REVERSAL strategies are a better option. The sharper the break, the better for an entry with the expectations that the MKT is going to revisit the recent move high. BUY DIR and UP BREAKOUT strategies may need to be "worked" as the MKT is extended and has the potential to produce some starts and stops.

Today's PRICE MAP Performance for SP

Wrap Up

- In a relatively quiet day in the markets, there was still opportunity to realize profits in the S&P 500. The market has produced a huge positive signal and will need to hold structure if the shift in sentiment is to be accepted. By putting the R at the DIR, the analyst is saying "prove it" to this positive technical shift. If price breaks below the DIR, there is a possibility for a drop back down into a digestive market state. The Market traded down to the DIR around 8 A.M., respected it, and began back up toward the minor level at 1437.75. When the price failed to make a higher move high around 12:30, this was an indication of structural weakness. When the price broke below the R just before 2 P.M., we knew just what to do, SELL the DIR BREAKOUT. This strategy is aggressive and demands tight position management. As it happened, there was a sharp sell-off from the R and wasted no time before moving down to the DP, a reasonable profit target considering the Market State and time of day.

Today's MARKET STATE for EURO CURRENCY: **BULL TREND CORRECTION**

- The MKT has a soft tone against an underlying positive trend. On the SELL side accept UP FADE signals on the 1st or 2nd press into the area only. REVERSAL strategies should only be done off the UP or the previous session high point and will immediately work if they are going to. Keep position and risk management tight on these trades. SELL DP BREAKOUT strategies are aggressive but do have potential to be the start of a larger corrective turn. Keep risk management tight.

- On the BUY side accept REVERSAL signals off all major inflection levels, expecting the underlying positive momentum to resume. DP FADE strategies will work better with confirmation as the MKT is in a corrective state and will be probing lower looking for soft spots. Work any BUY DIR and UP BREAKOUT strategies as any positive shift in momentum has the potential to be the start of the next leg higher. DIR FADE strategies after the UP Breakout should use greater leverage.

Today's PRICE MAP Performance for EU

Wrap Up

- Today we had a CORRECTIVE signal in an underlying BULL TREND Market. With the R Level at the DIR, we are looking to accept BUY signals above that level with the expectation that a breakout of the Critical Range could be a resumption of the bull trend. At 2:30 A.M., we are given out BREAKOUT signal as the market penetrated the UP. If a trader hadn't gotten long the market at this point, they should have definitely been long the market after the UP held support just after 4 A.M. The market continued higher throughout the morning session, had a brief pullback at the UT1, then hosted a fierce rally taking price all the way up to our target at the UT2 where profits should have been realized. Price had a brief correction, similar to the one seen at the UT1, and then continued through the UT2 making it all the way up to the second minor level above the UT2 at 1.2814. Defining Market State, Structure, and Strategy proved to be a profitable formula for trading the EURO CURRENCY today.

Today's MARKET STATE for S&P 500 INDEX: **NEUTRAL DIGESTION**

- Technically the MKT is "on the fence" with the potential to go in either direction or nowhere. Pick your points and have no expectations, as the likelihood of this MKT trading sideways is high.

- On the SELL side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The pivotal nature of the session does have the potential to be the starting point for a new move. However, the probability of any trend action is more likely to just be the MKT defining its new consolidation extreme.

- On the BUY side BREAKOUT, FADE and REVERSAL strategies are valid, however profit and position risk management should be aggressive and anticipated. The MKT is "on the fence" and does have the potential to be the beginning of a new trend move. The probability of a new trend move is low. However, any price trend action is more likely to just be the MKT defining its new consolidation extremes.

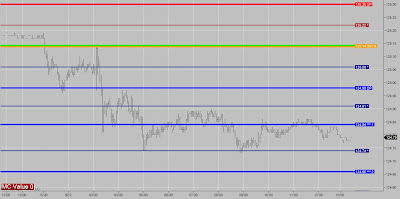

Today's PRICE MAP Performance for SP

Wrap Up

- With an MC Value of +1 and a NEUTRAL DIGESTION Market State, the S&P 500 INDEX was on the fence today with the potential to start a new trend move. As the day progressed, you could almost feel the market trying to breakout of the Critical Range and start a new move higher. We had a test of the UP around 4 A.M, a little after 5:30, at 7:30, and again around 8 A.M. Then, just after 8:30 A.M., we are given a decisive breakout signal, allowing traders to execute a BUY UP BREAKOUT strategy. The market rallied sharply stabilized for a minute at the UT1, and then proceeded to rally all the way up to our upside target for the trade, the UT2. Defining Market Structure everyday is essential to being a profitable trader. Today's Price Map performance illustrates how defining Market Structure will translate to profitable trade execution.

Today's MARKET STATE for BRITISH POUND: **BULL TREND**

- Technically the MKT is in a positive posture and as long as it continues to hold structure, further gains should be expected. If the integrity of the previous session low remains intact, look for excuses to get long.

- On the SELL side UP FADE strategies are valid but profit targets and risk management should be tight. REVERSAL strategies should be applied only at the UP and +c after an exhaustive signal. Use DP BREAKOUT strategies as a signal to FADE a positive reaction against the DIR. Only until the MKT breaks the positive structure are sell signals an opportunity.

- On the BUY side BREAKOUT, FADE and REVERSAL are recommended as the MKT is bid and all buy signals are valid opportunity. If stopped out at or near the low tic of a reaction and the MKT is not following through to the downside, look to re-enter using the recent squeeze low as a stop. If the MKT breaks structure, de-leverage and be more selective as the likelihood of a sideways trade is high.

Today's PRICE MAP Performance for BP

Wrap Up

- For the second day in a row, we have a BULL TREND Market State performing EXACTLY to expectations. Today in the BRITISH POUND currency, we had a MC Value of +5 and a BULL TREND Market State. Our stategy in todays trading environment is to accept all BUY signals off major inflection points, with the best risk-reward trade being a BUY R FADE strategy. The R Level is placed by an analyst and represents the level above which traders should BUY the market, and below which traders should look to SELL the market. Around 3:00 A.M. the market sold off dramatically, stabalized just above the R around 1.5823 and then rallied violently. Using the JS Price Map, a trader would have executed a BUY R FADE strategy just after 3 A.M. The market performed to our expectations, respected the R Level, and rallied for the next 4 hours. Price blew through the DIR, surpassed the UP (our target), and eventually made it all the way up to the UT1. Profits could have been realized at our profit target at the UP; however, had a trader stayed in the position after the UP was achieved, he or she would have been rewarded hansomely as the market traded up to the UT1 just after 7 A.M.