Risk Management Strategies Using Inflection Pivots

Inflection Pivot analysis is a guide to the psychological landscape of a market, identifying price points where shifts in sentiment will occur. These points of inflection can be used for directional trading opportunity as well as the basis of a hedge or risk management program.

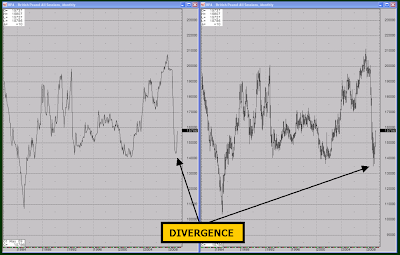

Referring to the May 26, 2009 post regarding the USDJPY cross rate.

A Japanese Corporate uses YEN [JPY] to buy U.S. Dollars [USD] to purchase US goods or receives USD for goods sold and needs to convert the USD to JPY to pay employees and shareholders. The fluctuations of the conversion rate can have a significant impact on the corporate bottom line if this is not managed properly.

To protect itself from the currency fluctuations the Corporate will hedge its exposure by taking an opposing trade to their underlying position. So if they are net long JPY and will need to pay USD for goods [LONG JPY/ SHORT USD] they will put on an opposite trade [SHORT JPY / LONG USD] to lock in a “guaranteed rate” that they can then use to base their cost analysis on.

This hedge is a form of insurance. Insurance can be expensive.

To reduce costs the Corporate may not always be hedged and will assume an acceptable variance of cross rate risk and only hedge significant “worst case” shifts. How is this acceptable variance derived and what constitutes “worst case”? This is basically an internal risk management overlay of what “works” for the corporate risk appetite.

In addition to any transaction cost there is an additional “opportunity cost”. If the USD depreciates this will be a good thing as the cost of goods to purchase will be less, basis JPY. By hedging out the adverse affects of cross rate volatility we also exclude the positive effects.

So how can we use inflection pivot analysis to improve a hedge strategy.

On May 26, 2009 the Inflection Pivot Blog outlined parameters for a hedge strategy.

Assuming we are net LONG JPY verses the USD. Our position is vulnerable to an increase in the USDJPY. A hedge would be to go long the USDJPY. The question is, are we at risk and if we are where do we buy?

From the analysis we read:

The USDJPY is trying to transition into a positive position and will maintain this posture above the 9355-9340 Inflection Pivot.

Our position is vulnerable as the MKT is above the 9355 Inflection Pivot and we should consider a hedge immediately with the expectation of the USDJPY appreciating.

If the MKT is good it will stabilize above here. A breach of 9670 is encouraging however a violation of the 9971 Resistance Inflection Pivot is needed to signal a positive acceleration in momentum targeting 10697 and 11272-11235 on the move.

Reading further into the work our initial risk is up to 9971 in the USDJPY. Potentially this is the high point of an acceptable variance. Trading above 9971 however and we are risk for a much more significant price move up to 11272. If we are not long already, we should definitely go long USDJPY above this inflection point to hedge our position.

A break under 9277 and the USDJPY revisits the 8715 recent low point where buying should be expected. A test of this support is negative however and positive reactions should be considered opportunities to FADE.

A failure from the 8715 support inflection pivot will extend the weakness down to the 8030-7830 support band. Look for buying opportunities in this zone as no immediate follow through is expected and the outlook a 3-5 month digestive rally out of this zone.

In summary from the Inflection Pivot analysis we should only become comfortable with the cross rate going in our favor below 9277 and at this time remove any hedge, as expectations are that the USDJPY will drop down to 8715 if not the 8030 area. If our expectations are correct we should consider applying a hedge in the 8030 area to lock in a favorable rate, as an appreciation of the USDJPY is the outlook from this support base.

The Inflection Pivot work can be used to manage an outright long position in the USDJPY or for the construction of option-spread positions using the inflection pivot points as strike price levels.

By defining significant psychological points of inflection we put structure to random price action and provide a framework to create hedge strategies that anticipate shifts in market sentiment and price.

For more information please contact me directly at info@jsservices.com.

JS

Inflection Pivot analysis is a guide to the psychological landscape of a market, identifying price points where shifts in sentiment will occur. These points of inflection can be used for directional trading opportunity as well as the basis of a hedge or risk management program.

Referring to the May 26, 2009 post regarding the USDJPY cross rate.

A Japanese Corporate uses YEN [JPY] to buy U.S. Dollars [USD] to purchase US goods or receives USD for goods sold and needs to convert the USD to JPY to pay employees and shareholders. The fluctuations of the conversion rate can have a significant impact on the corporate bottom line if this is not managed properly.

To protect itself from the currency fluctuations the Corporate will hedge its exposure by taking an opposing trade to their underlying position. So if they are net long JPY and will need to pay USD for goods [LONG JPY/ SHORT USD] they will put on an opposite trade [SHORT JPY / LONG USD] to lock in a “guaranteed rate” that they can then use to base their cost analysis on.

This hedge is a form of insurance. Insurance can be expensive.

To reduce costs the Corporate may not always be hedged and will assume an acceptable variance of cross rate risk and only hedge significant “worst case” shifts. How is this acceptable variance derived and what constitutes “worst case”? This is basically an internal risk management overlay of what “works” for the corporate risk appetite.

In addition to any transaction cost there is an additional “opportunity cost”. If the USD depreciates this will be a good thing as the cost of goods to purchase will be less, basis JPY. By hedging out the adverse affects of cross rate volatility we also exclude the positive effects.

So how can we use inflection pivot analysis to improve a hedge strategy.

On May 26, 2009 the Inflection Pivot Blog outlined parameters for a hedge strategy.

Assuming we are net LONG JPY verses the USD. Our position is vulnerable to an increase in the USDJPY. A hedge would be to go long the USDJPY. The question is, are we at risk and if we are where do we buy?

From the analysis we read:

The USDJPY is trying to transition into a positive position and will maintain this posture above the 9355-9340 Inflection Pivot.

Our position is vulnerable as the MKT is above the 9355 Inflection Pivot and we should consider a hedge immediately with the expectation of the USDJPY appreciating.

If the MKT is good it will stabilize above here. A breach of 9670 is encouraging however a violation of the 9971 Resistance Inflection Pivot is needed to signal a positive acceleration in momentum targeting 10697 and 11272-11235 on the move.

Reading further into the work our initial risk is up to 9971 in the USDJPY. Potentially this is the high point of an acceptable variance. Trading above 9971 however and we are risk for a much more significant price move up to 11272. If we are not long already, we should definitely go long USDJPY above this inflection point to hedge our position.

A break under 9277 and the USDJPY revisits the 8715 recent low point where buying should be expected. A test of this support is negative however and positive reactions should be considered opportunities to FADE.

A failure from the 8715 support inflection pivot will extend the weakness down to the 8030-7830 support band. Look for buying opportunities in this zone as no immediate follow through is expected and the outlook a 3-5 month digestive rally out of this zone.

In summary from the Inflection Pivot analysis we should only become comfortable with the cross rate going in our favor below 9277 and at this time remove any hedge, as expectations are that the USDJPY will drop down to 8715 if not the 8030 area. If our expectations are correct we should consider applying a hedge in the 8030 area to lock in a favorable rate, as an appreciation of the USDJPY is the outlook from this support base.

The Inflection Pivot work can be used to manage an outright long position in the USDJPY or for the construction of option-spread positions using the inflection pivot points as strike price levels.

By defining significant psychological points of inflection we put structure to random price action and provide a framework to create hedge strategies that anticipate shifts in market sentiment and price.

For more information please contact me directly at info@jsservices.com.

JS