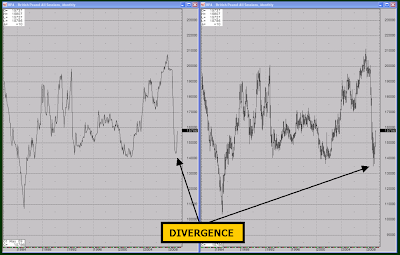

The BRENT CRUDE [ICE] JUL'09 contract is heating up and will maintain an aggressive buy posture above the 58.82 Inflection Pivot.

61.98 is the initial resistance that is expected to challenge any new buying. How the MKT reacts here will gauge the next move. A violation and Daily close above 62.38 and it is just a matter of time before we see $68 and $74 oil.

A rejection from 61.98 and things can get a little slippery with a big sideways trade. 58.82 will remain pivotal but 55.91 is the support inflection pivot.

If the current strength struggles below 58.82, 55.91 is expected to prove the next bounce.

JS

61.98 is the initial resistance that is expected to challenge any new buying. How the MKT reacts here will gauge the next move. A violation and Daily close above 62.38 and it is just a matter of time before we see $68 and $74 oil.

A rejection from 61.98 and things can get a little slippery with a big sideways trade. 58.82 will remain pivotal but 55.91 is the support inflection pivot.

If the current strength struggles below 58.82, 55.91 is expected to prove the next bounce.

JS