Tuesday, October 27, 2009

Entry Strategies

The following webvideo http://www.jsservices.com/education/sbt/CME_EntryStrategies5min.wmv goes over an entry strategy technique in the ND100 Index.

JS

Sunday, October 25, 2009

BULL TREND CORRECTION: SP500, ND100, DOW30, AUDUSD, CORN, GOLD

Wednesday, October 21, 2009

BULL TREND CORRECTION SIGNAL for SP, DOW, MidCap400, 5yr, 30yr, BOBL, BUND, DAX, EuroStoxx and FTSE

Today we are going to focus on MKTs that have produced a negative signal against an underlying positive trend or a BULL TREND CORRECTION signal state. The question, is this negative signal going to follow through or is this just a 1 day event and the underlying positive momentum is going to resume. The price point that answers this question and determines this "sentiment shift" is the session Inflection Pivot. This is the price point that defines the technical state from being a negative "corrective"posture below that price point to a positive BULL TREND position above that price point.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.For OCTOBER 22, 2009 below are the MKTs that are in a BULL TREND CORRECTIVE state and the Inflection Pivot that determines the contiuation of the sell signal or a reversion to the underlying positive trend.

EQUITY FUTURES [DEC09]

SP500 1083.75

Dow Fut 9927

MidCap400 701.90

DAX 5785

EuroStoxx 2880

FTSE100 5230

INTEREST RATE FUTURES [DEC09]

US 30YR T-BOND 120-25

US 5YR T-NOTE 106-057

BUND 12183

BOBL 11528

Draw a line on your intra-day chart at these levels. Look for opporunty in the direction of the price bias. Executing at or near these price points will provide the best risk / reward. SELL FADE and BUY BREAKOUT should be considered as entry strategies at these levels.

Good Trading.

JS

Strategy Based Trading is a methodology that focuses on the applied strategy verses a specific market and looks to align strategies with markets whose current technical behavior matches the strategies criteria.

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Tri

Monday, October 19, 2009

EuroFX - Mixed Signals

A slip under 14951 sets up a test of the 14897 support Inflection Pivot. If the underlying positive tone is going to hold so will this support. A failure here and the currency slips back into a digestive trade down to 14822 and 14796 on any short term sentiment shift. Be patient. If this is just a bunch of mind games that contract will maintain its composure. A break under 14758 confirms a negative turn forecasting a decline down to 14565 and 14514. Expect no follow through.

JS

For more information on JS Services please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial

Sunday, October 18, 2009

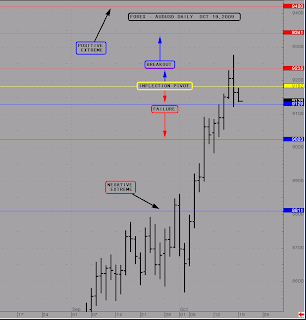

Strategy Based Trading - BULL TREND CORRECTION

Today we are going to focus on MKTs that have produced a negative signal against an underlying positive trend or a BULL TREND CORRECTION signal state. The question, is this negative signal going to follow through or is this just a 1 day event and the underlying positive momentum is going to resume. The price point that answers this question and determines this "sentiment shift" is the session Inflection Pivot. This is the price point that defines the technical state from being a negative "corrective"posture below that price point to a positive BULL TREND position above that price point.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

Trading below the session Inflection Pivot or what JS Services calls its REVERSAL LEVEL or R Level is negative keeping the CORRECTIVE SELL signal in play and the MKT vulnerable. Trading above this price point is an indication that the negative vulnerability of the MKT is reduced and there is a better chance that the underlying positive momentum is going to resume.

Starting the week of OCT 19, 2009 the Canadian Dolllar and 2yr T-Note futures and the FOREX AUDUSD major cross rate are in the BULL TREND CORRECTION technical state.

Canadian Dollar Dec'09 contract

Expectation today are that Friday's negative signal will weigh on the MKT below the 9663 Inflection Pivot, pressing support at 9606. If the currency is going to stabilize it will do so above here. A held failure and the MKT is vulnerable to further corrective action down to 9492 and 9406 on any negative follow thourhg.

A held trade above 9663 puts the negative signal in question and the contract in a neutral digestive position. Only above 9720 is the underlying BULL TREND back in gear targeting 9834 on any positive turn of events. 10062 is the upper extreme.

The 2YR T-NOTE is flirting with a underlying sentiment shift with all trading below the 108-180 Inflection Pivot. A held failure from 108-152 confirms Friday's "corrective" signal targeting 108-105 on any downside follow through. If the trade is going to remain "normal" the MKT will stabilize above here. A break under 108-105 and the contract is vulnerable to further losses down to 108-005.

A rise above 108-180 takes the edge off for more of a digestive trade up to 108-207. Be patient. This is the high point for any lackluster trade. A violation here and the underlying BULL TREND will trying to re-establish itself targeting 108-255. 109.035 is the upper extreme.

FOREX AUDUSD

The AUDUSD cross produced a negative signal that will remain in play with all trading below the 9182 Inflection Pivot. A break under 9129 is needed to confirm fresh losses targeting 9023 on any downside follow through. Be patient if the MKT is going to stabilize it will here. If not the potential to transition down to 8811 is real.

A held trade above 9182 puts the contract back into a digestive trade. Only above 9235 does the underlying positive momentum try to re-assert itself for a run at 9341. 9420 is the current upper extreme.

As you read through the different outlooks one thing is apparent. They are all basically the same. That is the point of the Strategy Based Trading Approach.

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

By developing strategies to capitalize in this technical signal state you not only improve your chances of success but also develop a comfort with the market action during this state and improve your confidence in executing your strategy in that state.

For more information and to receive a complimentary trial of my service which defines these signal states please send inquires to info@jsservices.com or click here for a Complimentary FREE Trial.

JS Services is here to support your profit objectives.

It's our job to help you make more money.

Stop analyzing, start executing and see the difference in your bottom line.

Hope this helps.

Good trading.

JS

Thursday, October 15, 2009

GOLD - Is that It?

A rise above the 1061.7-1060.8 resistance band will bring in some fresh interest. Work the bid. The aggressive advance will be ready to engage with 1082.6 and 1098.9 targeted.

JS

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.

Wednesday, October 14, 2009

British Pound - Bear Trend Correction