- The MKT is in a sideways digestive position with a slight positive bias.

- On the SELL side avoid DP BREAKOUT strategies but rather FADE a positive reaction against the DIR after a negative breakdown signal. UP and UT1 REVERSAL strategies are recommended over FADE strategies as "sloppy" trading conditions are expected. Any UP FADE trades should get confirmation first.

- On the BUY side UP BREAKOUT strategies are valid but should expect a laborious trade. Work any position, selling into emotional surges and re-entering on any sharp pullbacks. Expect a choppy trade and be aggressive on minimizing profit give-back. DP and DT1 FADE and REVERSAL strategies are recommended.

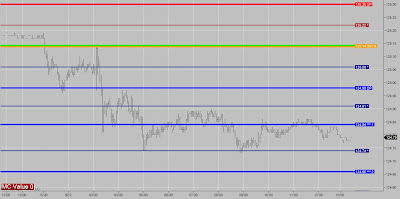

Today's PRICE MAP Performance for BP

- Trading the Playbook today in the BRITISH POUND proved to be extremely profitable. With an MC Value of +1 there is a slight positive tone to the NEUTRAL DIGESTION Market State. The R Level at the UP represents the Sentiment Bias for the day If the market is going to stay in a digestive zone, it should remain below the R; however, a breach of the R could mean the resumption of a new move higher. As stated in our commentary, UP BREAKOUT trades are valid but should expect a laborious trade. Chances are you missed the the BREAKOUT signal that occurred last night around 11 P.M. With that being said, the market sold off to the R level where it held SUPPORT. This was a very bullish signal and an opportunity to get long from the R Level at 3 A.M. The market rallied violently and, within an hour, the price target at the UT2 had been achieved. The market met resistance at the first minor level above the UT2 (1.6301) and then cooled off from there. After digesting between the UT1 and UT2 from 8 A.M. to 10 A.M. the market broke back down to the R Level just after 11 A.M. and remained there for the remainder of the session.