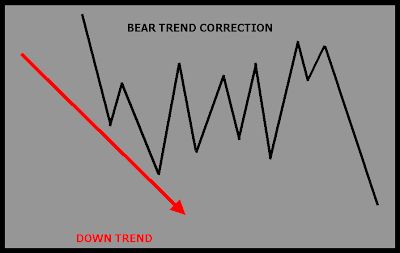

Technically the MKT is in a BEAR TREND ACCELERATION position and is vulnerable to the offer with all trading below the 16190 Inflection Pivot . Any positive corrective action is expected to be short lived with only one upside "stop squeeze" exhuasting below 16190, if the negative moemtnum is going to play out. Any held strength and repeated probe higher is a sign that the trade will turn digestive. This does not take away from the negative bias but does limit the profit potential for any new sales in the session.

On the SELL side accept FADE, REVERSAL and BREAKOUT strategies below the previous sessions high point. BREAKOUT strategies below the 15946 support pivot should just "go", so do not risk much. FADE strategies against 16068 and 16190 resistance are recommended over REVERSAL strategies as the MKT is expected to hold lower structure and any momentum shift should be considered a potential positive corrective turn.

On the BUY side avoid REVERSAL strategies off major support levels as these signals are more likely short squeeze rallies and opportunities to SELL into and FADE. BREAKOUT strategies above the 16068 resistance pivot are a long shot, so risk less and go for more using the 16190 level as the target. Any BUY FADE off the 15946 support pivot should have confirmation and are not recommended if the integrity of the previous session high is intact. After a break in the negative structure confirmed support levels can be used for short term reactions using aggressive position management.

Note: The MKT is in an aggressive sell posture. If the previous session high is intact its just a matter of time before the sellers try to overwhelm the MKT. Look for excuses to get short. If the previous session high is breached opportunity will be on both sides of the MKT, however the bias still rests with the Bears.

JS

This post supports the Strategy Based Trading, which is a methodology that focuses on the applied strategy verses a specific market. The approach looks to align strategies with markets whose current technical behavior matches the strategies criteria. Please review the following CME sponsored tutorial for a complete overview of this approach.

STRATEGY BASED TRADING Review http://progressive.powerstream.net/008/00102/edu/interactive/js_services/strategy_based_trading/index.html

For more information please contact me at info@jsservices.com. You can also visit http://www.jsservices.com/.The Inflection Pivot levels are available as a chart overlay on the following platforms; Ninja trader, Strategy Runner and eSignal. Sign up for a Complimentary FREE Trial.